To help retail IT VARs and ISVs effectively understand the Canada Emergency Wage Subsidy (CEWS), Paul Leduc, Chairperson of the RSPA’s Canadian Community and the President of Globe POS Systems, a value-added reseller headquartered in Brampton, Ont., shared this summary and actionable information.

Summary

The Canada Emergency Wage Subsidy is a $83.6 Billion program for employers to continue paying employees.

On July 27, 2020, the Department of Finance Canada provided an update on this program and what employers can expect from these announcements. Summarized below is the information that is currently available as Monday, July 27, 2020.

What is it?

A base CEWS subsidy is available for all employers impacted: there will now be a base subsidy available to all eligible employers that are experiencing a decline in revenues. The rate of the base CEWS now varies depending on the level of revenue decline. Unlike in period 1 – 4, the application of CEWS is now extended to ALL employers with a revenue decline of any sort. This expansion means that all eligible employers with a revenue decline will now qualify for CEWS support.

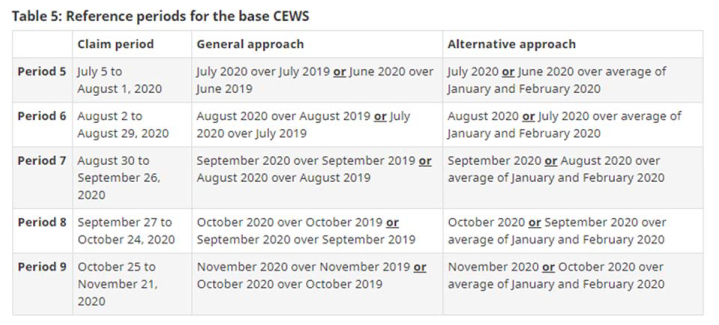

Please see table 5 below that outlines each claiming period and the relevant period for determining an eligible employer’s change in revenue.

*NEW* Top-up Subsidy Available

The top-up subsidy is available for the most adversely affected employers: the government has announced a new subsidy amount available for eligible employers of the CEWS that have had a decline in revenue of more than 50% over a 3-month period. A top-up CEWS amount of up to 25% is available if you are determined to be eligible.

The overall CEWS rate would be equal to the top-up CEWS rate plus the base CEWS rate previously mentioned. For example, if you have experienced a 60% drop in revenue over a 3-month period you are now entitled to an additional CEWS subsidy amount.

Table 6 below outlines each claiming period and the relevant period for determining an eligible employer’s average change in revenue for the top-up amount.

Who is an Eligible Employer & Employee?

Eligible employers include individuals, taxable corporations and trusts, partnerships consisting of eligible employers, non-profit organizations and registered charities. Public institutions are generally not eligible for the subsidy. As announced on May 15, 2020, eligible employers also include the following groups:

- Partnerships that are up to 50-per-cent owned by non-eligible members

- Indigenous government-owned corporations that are carrying on a business, as well as partnerships where the partners are Indigenous governments and eligible employers

- Registered Canadian Amateur Athletic Associations

- Registered Journalism Organizations

- Non-public colleges and schools, including institutions that offer specialized services, such as arts schools, driving schools, language schools or flight schools

An eligible employee is an individual who is employed in Canada. Effective July 5, 2020, the eligibility criteria would no longer exclude employees that are without remuneration in respect of 14 or more consecutive days in an eligibility period.

Disclaimer: Please note the views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of the Retail Solutions Providers Association. The information in the article is provided with the knowledge that the author does not offer any legal or other professional advice. In the case of a need for any such expertise, consult with the appropriate professional. This article does not contain all information available on the subject of Canada’s Emergency Wage Subsidy. This article has not been created to be specific to any individual’s or organization’s situation or needs. Every effort has been made to make the article as accurate as possible. However, there may be typographical and/or content errors. Therefore, this article should serve only as a general guide and not as the ultimate source of subject information. This article contains information that might be dated. The author and RSPA shall have no liability or responsibility to any person or entity regarding any loss or damage incurred, or alleged to have been incurred, directly or indirectly, by the information contained in this article.