By Denis Okazaki, Chief Product Officer, Yazara

As digital payment methods swiftly become the norm, the security of these transactions stands out as a paramount concern for both customers and merchants. As the concept of Software Point of Sale (SoftPOS) continues to gain traction and broader acceptance, the perceived lack of security associated with this technology can often act as a deterrent for individuals looking to embrace this innovative payment method. However, our primary mission is clear: to gain both merchant and consumer trust by providing a highly compliant and secure payment acceptance solution that goes hand-in-hand with educating the market to address these security apprehensions.

The cornerstone of payment security within the SoftPOS ecosystem commences with the physical handheld device and extends seamlessly throughout the entire transaction flow. This encompasses the journey from the device to our back-end host and onward to the acquirer for processing. Modern SoftPOS solutions have been meticulously engineered to offer the most secure methods of payment acceptance available today. These solutions integrate robust security measures, including the revolutionary concept of white-box cryptography, which significantly enhances security levels, surpassing the capabilities of conventional Point of Sale (POS) devices.

White-box cryptography is a software-based approach specifically designed to safeguard cryptographic keys. It achieves this through techniques like obfuscation, encryption, and other transformational methods that conceal and safeguard keys and algorithms, even when the device itself may be compromised. Importantly, this methodology fully complies with EMV and PCI standards and our implementation undergoes rigorous certification processes conducted by accredited laboratories, ensuring its suitability for commercial use.

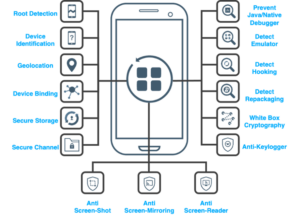

The latest SoftPOS solutions offer an impressive array of security protections. Key measures within these security frameworks include:

- Anti Key-logger: Prevents unauthorized keystroke capture.

- Emulator Detection: Identifies attempts to emulate the SoftPOS environment.

- Repackaging Detection: Alerts to potential tampering or unauthorized modifications.

- Root Detection: Detects if the device has been rooted, a common method of bypassing security.

- Java and Native Hooking Framework Detection: Identifies potential exploits targeting Java and native code hooks.

- Anti Java/Native Debugger: Prevents debugging attempts on the SoftPOS application.

- Anti User and System Screen Shot: Shields against unauthorized screen capturing.

- Anti Screen-mirroring: Detects and prevents screen-mirroring activities.

- Anti Screen-reader: Thwarts attempts to use screen-reader tools for unauthorized access.

- White-box Cryptography: Safeguards cryptographic keys and algorithms, even in compromised environments.

- Check Trusted Keyboard: Ensures the use of a trusted keyboard for secure data entry.

By selecting these solutions, both merchants and consumers can have confidence in the safety and security of their payment transactions. SoftPOS technology is a testament to the power of innovation and has evolved to a level where security is paramount at every stage of our solution, delivering a dependable and secure payment acceptance experience that is fully certified and endorsed by the payment schemes.

Moreover, the statistics speak volumes. With more than 60% of retailers already implementing or planning to adopt SoftPOS solutions within the next 12 months, it is clear that SoftPOS has not only gained recognition but also is poised to redefine the landscape of secure and convenient payment acceptance in the retail sector.

In this ever-evolving digital landscape, SoftPOS stands as a beacon of security, safeguarding the interests of both customers and merchants alike. By investing in these advanced technologies, we not only bolster transaction security but also contribute to the ongoing transformation of the payment landscape. Security is not just a feature; it’s the very foundation upon which SoftPOS thrives, delivering a reliable and secure payment acceptance experience that paves the way for a more secure and convenient future in payments.

About the Author

Denis Okazaki serves as the Chief Product Officer for Yazara Payment Solutions, Inc. In this role, Okazaki is responsible for ideating, building, and delivering innovative product features and managing the company’s product roadmap for Yazara’s SoftPOS solution.

Prior to joining Yazara, Denis was the Group Executive, New Products and Innovation for FIS Global. He has over 30 years of global experience in strategic planning, developing, and delivering innovative products, services, and solutions, and achieving high revenue growth, positive operating leverage, and customer success. Specific to the payments industry vertical, he has worked the last 20+ years within highly available, mission-critical payments businesses with stringent, time-sensitive service levels, holding senior executive positions with FIS Global, Momo Group, Citigroup, and First Data. As part of this experience, he has lived and worked across 6 continents and 40+ countries.

Okazaki holds a bachelor’s degree from the University of California, San Diego and has completed additional graduate coursework at UCSD and SDSU. He volunteers for various charities and organizations including the Volunteers of America, Habitat for Humanity, Toys for Tots, and Give Kids the World Village. Having been born and raised in Japan, he is a native speaker of Japanese.

Denis Okazaki serves as the Chief Product Officer for Yazara Payment Solutions, Inc. In this role, Okazaki is responsible for ideating, building, and delivering innovative product features and managing the company’s product roadmap for Yazara’s SoftPOS solution.

Prior to joining Yazara, Denis was the Group Executive, New Products and Innovation for FIS Global. He has over 30 years of global experience in strategic planning, developing, and delivering innovative products, services, and solutions, and achieving high revenue growth, positive operating leverage, and customer success. Specific to the payments industry vertical, he has worked the last 20+ years within highly available, mission-critical payments businesses with stringent, time-sensitive service levels, holding senior executive positions with FIS Global, Momo Group, Citigroup, and First Data. As part of this experience, he has lived and worked across 6 continents and 40+ countries.

Okazaki holds a bachelor’s degree from the University of California, San Diego and has completed additional graduate coursework at UCSD and SDSU. He volunteers for various charities and organizations including the Volunteers of America, Habitat for Humanity, Toys for Tots, and Give Kids the World Village. Having been born and raised in Japan, he is a native speaker of Japanese.